Attention all military personnel eyeing a move to Idaho! If you’re dreaming of owning a home in the Gem State, your military service comes with a powerful advantage: the VA loan. This incredible benefit offers you a pathway to homeownership with no down payment, competitive interest rates, and flexible credit requirements.

With the 2024 VA loan limits seeing a significant increase across the nation, your options for buying your dream home in Idaho have expanded even further. Imagine yourself settling into a vibrant community with breathtaking landscapes, world-class outdoor adventures, and a lower cost of living than many other states. Idaho’s unique blend of natural beauty, strong economy, and welcoming atmosphere makes it an ideal destination for military families.

Whether you’re stationed at Mountain Home Air Force Base or looking to retire amidst Idaho’s tranquil surroundings, understanding the VA loan limits in Idaho is crucial.

2024 VA Loan Limit Changes: A Big Boost for Idaho Homebuyers

The year 2024 has brought about a significant shift in VA loan limits. Across most of the United States, the limit for a single-family home has been raised to $766,550, a substantial increase from the 2023 limit. What does this mean for you? It means greater buying power and the ability to consider a wider range of homes in Idaho without needing a down payment. Even better, for those with full VA loan entitlement, there are no longer any loan limits, opening up a world of possibilities!

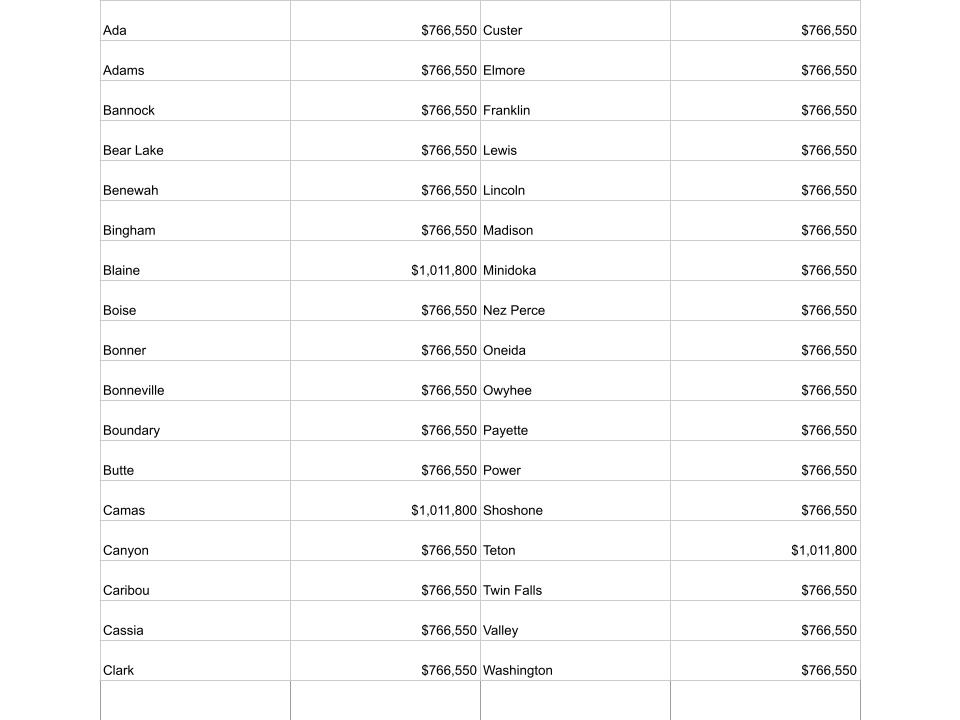

VA Loan Limits in Idaho: County-by-County Breakdown

Idaho, with its diverse landscape and thriving communities, offers various VA loan limits depending on the county. To help you navigate Idaho’s diverse housing market, we’ve compiled a comprehensive list of the 2024 VA loan limits for every county in the state:

For most counties, the limit aligns with the national average of $766,550. However, some areas, like Blaine, Camas, and Teton counties, boast higher limits due to their unique housing markets, providing even more opportunities for veterans and military families to find their dream homes.

For most counties, the limit aligns with the national average of $766,550. However, some areas, like Blaine, Camas, and Teton counties, boast higher limits due to their unique housing markets, providing even more opportunities for veterans and military families to find their dream homes.

Understanding these county-specific limits is crucial when planning your move to Idaho. It allows you to strategically choose a location that aligns with your budget and desired lifestyle.

VA Loan Eligibility and Entitlement: Your Keys to Idaho Homeownership

To take advantage of these generous VA loan limits, it’s essential to understand the eligibility requirements and your entitlement. To be eligible, you generally need to have served a minimum amount of time in the military, with variations depending on your service era.

Your entitlement determines how much of a loan the VA will guarantee. While having full entitlement means no loan limits, it’s important to remember that lenders may still have their own restrictions. It’s always wise to consult with lenders to fully understand your borrowing capacity.

Financial Considerations for Military Relocation to Idaho

Relocating to Idaho as a military family involves careful financial planning. While the VA loan offers significant advantages, it’s essential to factor in all costs associated with your move and new life in the Gem State.

Housing Costs:

- VA Loan Limits: As outlined in the table above, VA loan limits vary by county in Idaho. Knowing these limits will help you determine your maximum borrowing power without a down payment.

- Property Taxes: Research property tax rates in different Idaho counties, as they can vary significantly.

- Homeowners Insurance: Factor in the cost of homeowners insurance, which is typically required for VA loans.

- Basic Allowance for Housing (BAH): If you’re active duty, research the BAH rates for your rank and location in Idaho to understand your housing allowance.

Moving Expenses:

- Transportation: Budget for the cost of moving your belongings to Idaho, whether through a military-approved moving company or self-move options.

- Temporary Housing: If needed, factor in costs for temporary accommodations while you search for a permanent home.

- Miscellaneous Costs: Consider expenses for setting up utilities, obtaining new licenses and registrations, and other incidental costs associated with relocating.

Additional VA Loan Benefits:

- Funding Fee Exemption: Many veterans are eligible for a funding fee exemption, which can save you thousands of dollars on your loan.

- No Private Mortgage Insurance (PMI): Unlike conventional loans, VA loans don’t require PMI, reducing your monthly payments.

- Flexible Credit Requirements: VA loans often have more lenient credit requirements than conventional loans, making it easier for qualified veterans to get approved.

Tips for Financial Success:

- Get Pre-Approved: Obtain a VA loan pre-approval before you start house hunting. This will give you a realistic budget and make you a more attractive buyer to sellers.

- Research BAH Rates: Understand your BAH entitlement for your new duty station or desired location in Idaho.

- Work with a VA-Approved Lender: Choose a lender experienced in working with military borrowers and familiar with the unique benefits of VA loans.

- Seek Guidance from Military Relocation Specialists: Many military installations offer relocation assistance services to help you navigate the financial aspects of your move.

- Connect with Veteran Organizations: Local veteran organizations can provide valuable resources and support during your relocation process.

By carefully considering these financial factors and leveraging the benefits of the VA loan, you can smoothly transition to your new life in Idaho and achieve your dream of homeownership.

Navigating Idaho’s Real Estate Market and Military-Friendly Communities

Idaho’s real estate market is dynamic, offering a mix of affordability and desirable neighborhoods. As a military family, you’ll be pleased to find several military-friendly communities throughout the state. These communities often boast proximity to bases, supportive veteran resources, and a welcoming atmosphere for military personnel.

Researching these communities and understanding current market trends will empower you to make informed decisions and find the perfect place to call home in Idaho. Here are a few communities to consider:

Mountain Home:Home to Mountain Home Air Force Base, this city offers a strong sense of community and support for military families. The base itself provides various resources, and the surrounding area has affordable housing options and outdoor recreational opportunities.

Boise:Idaho’s capital city may not have a military base, but it offers a vibrant cultural scene, excellent schools, and a thriving job market. Its proximity to Mountain Home AFB makes it a popular choice for military families seeking a larger city with diverse amenities.

Coeur d’Alene:Nestled in the scenic Idaho Panhandle, Coeur d’Alene is known for its stunning lakefront views, outdoor activities, and friendly atmosphere. While not directly connected to a military base, its welcoming community and lower cost of living attract many veterans and military families.

Twin Falls:This growing city in southern Idaho boasts a strong economy, affordable housing, and easy access to outdoor adventures. Its close-knit community and numerous resources for veterans make it an appealing option for military families seeking a balance of urban amenities and natural beauty.

Idaho Falls:Situated near the Idaho National Laboratory, Idaho Falls offers a blend of urban and rural living. With a strong sense of community, excellent schools, and a variety of outdoor activities, it’s a welcoming place for military families to call home.

Relocating to Idaho? Partner with Katita Slemp, your military relocation specialist, to navigate the VA loan process and find the perfect community for your family. Call (208) 891-1222 today and let’s get started!